BT (LSE:BT.A) shares are up slightly today at the time of writing despite a set of disappointing Q3 results. Investors may be rushing to buy the stock for its 6.3% dividend yield, but I’ll be avoiding the FTSE 100 stalwart instead. Here’s why.

Negative data

My first impressions of BT’s latest update aren’t good. Although all of its core segments, bar Consumer, matched analysts’ estimates, the overall top line still missed the mark. With the exception of Openreach, all of its core segments also witnessed revenue declines as the cost-of-living crisis continued to bear down on consumer spending.

| Metrics | Q3 2023 | Q3 2022 | Growth |

|---|---|---|---|

| Consumer revenue | £2.44bn | £2.59bn | -6% |

| Enterprise revenue | £1.25bn | £1.30bn | -3% |

| Global revenue | £0.86bn | £0.87bn | -2% |

| Openreach revenue | £1.42bn | £1.36bn | 4% |

| Group revenue | £5.21bn | £5.37bn | -3% |

Additionally, while EBITDA saw tiny growth, it missed analysts’ estimates too. Free cash flow was also a disappointment as year-to-date figures are lagging far behind the full-year guidance BT originally shared. But what’s most concerning is the company’s dismal pre-tax profit, which would have affected the firm’s bottom line had it not been for tax benefits.

Should you invest £1,000 in Agronomics Limited right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Agronomics Limited made the list?

| Metrics | YTD 2023 | YTD 2022 | Growth |

|---|---|---|---|

| Free cash flow | £0.11bn | £0.88bn | -88% |

| EBITDA | £5.88bn | £5.71bn | 3% |

| Profit before tax (PBT) | £1.31bn | £1.54bn | -15% |

| Profit after tax | £3.88bn | £3.75bn | 3% |

Expanding its reach

Having said that, there were a couple of silver linings from the report that are worth mentioning. The first would be the continued expansion of Openreach. To complement this, the group saw record quarterly growth for its Fibre to the Premises (FTTP) base as well. This is good news considering the increasingly competitive landscape of the optic fibre market, and may be why BT shares are up.

To boost investor sentiment, CEO Philip Jansen reiterated the conglomerate’s outlook for the year. This took me by surprise as some of the year-to-date (YTD) figures are currently miles away from its guidance. Nevertheless, Jansen mentioned that free cash flow is heavily weighted towards Q4, which should boost EBITDA and receivable collections.

| Metrics | FY23 Outlook | YTD FY23 |

|---|---|---|

| Revenue | “Revenue growth” | -1% |

| EBITDA | >£7.9bn | £5.88bn |

| Capital expenditure | £5.0bn | £3.88bn |

| Free cash flow | £1.3bn to £1.5bn | £0.11bn |

| Cost savings to FY25 | £2.5bn to £3.0bn | N/A |

Poor signals

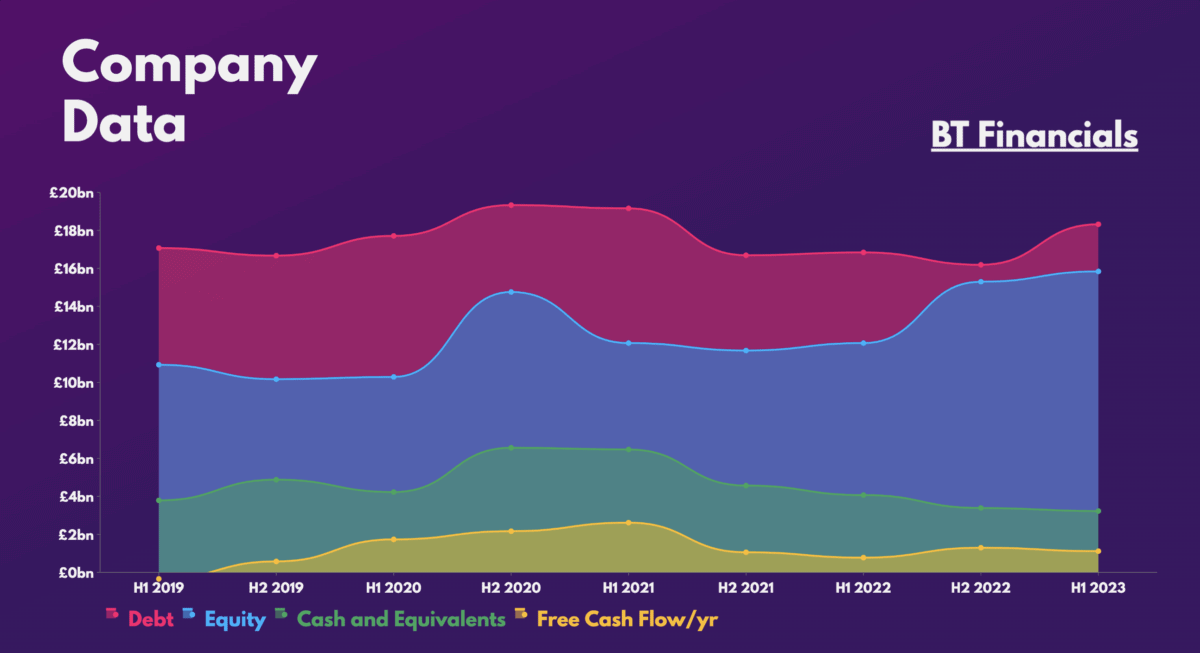

Will I invest in BT shares on the back of this reaffirmation of its guidance? Probably not. The telco giant still has plenty of headwinds to contend with. An impending recession paired with a slew of regulatory battles surrounding its price increases can very easily tip the scales for the worse. What’s more, its balance sheet is in tatters, which hasn’t been helped by a further increase in net debt this quarter.

That being said, BT shares do scream a bargain when assessing its valuation multiples. But I think this is a value trap given the fragile outlook for its top and bottom lines.

| Metrics | Valuation multiples | Industry average |

|---|---|---|

| Price-to-book (P/B) ratio | 0.8 | 1.8 |

| Price-to-sales (P/S) ratio | 0.6 | 1.2 |

| Price-to-earnings (P/E) ratio | 7.3 | 17.3 |

The likes of Goldman Sachs, Citi, and even Jefferies may have ‘buy’ ratings on the stock. However, I’m more inclined to side with Deutsche with its price target of £1.40 given my initial assessment of BT’s latest Q3 update. Thus, I won’t be starting a position any time soon.